DeeMoney's Enhanced Service Options for Sending Money to India: A Step Up for Individuals and Businesses!

DeeMoney is constantly revolutionizing and revamping our services, in an attempt to make financial transactions more streamlined, cost-effective and convenient for our customers. Now, with our latest update, DeeMoney has improved the way customers send money to India. This update caters to the needs of both businesses and individuals, as it provides a comprehensive extension of the payment features.

Among the plethora of new features, the B2P (Business-to-Person) Salary payment service is prominent, alongside the P2B (Person-to-Business) transfers that cater to diverse purposes.

The B2P salary payment option helps make business transactions easier. Businesses can now remit salaries to their employees in a more streamlined and secure manner. There are numerous businesses in Thailand with a significant workforce in India. Some businesses outsource their services to professionals in India and require to make salary payments on a monthly basis. With this feature, B2P transfers can be done swiftly and with the least amount of hassle, while ensuring salary payments are made in a timely manner.

P2B transactions cater to diverse needs. DeeMoney's platform ensures that your money transfers reach the recipient swiftly and safely. P2B transfers are made for a wide array of purposes, ranging from personal or medical emergencies to investment requirements.

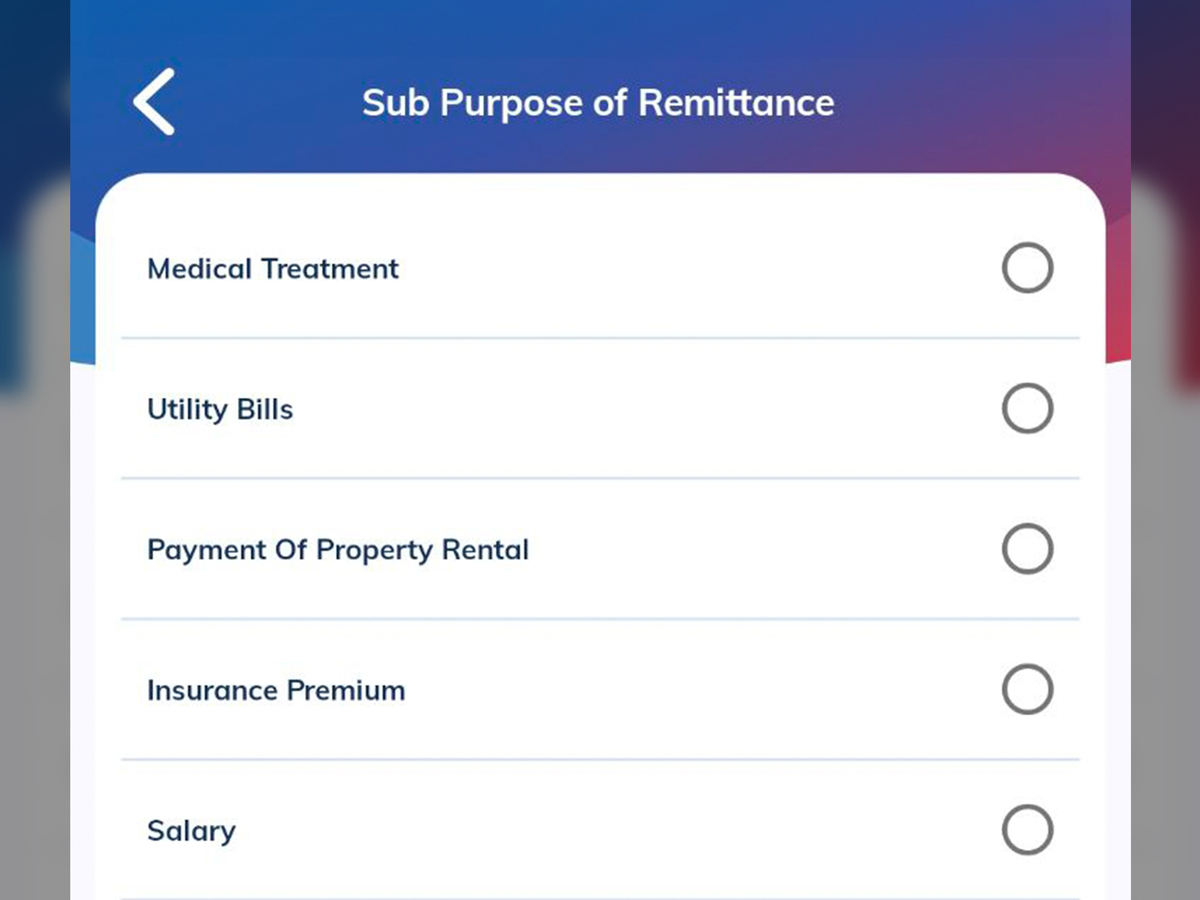

Let’s now look at the various sub-purposes under the miscellaneous services offered by DeeMoney.

Medical Treatment

Some emergencies can take you by surprise, and at such times you need a funds transfer service that’s safe, quick and hassle-free. DeeMoney’s update now allows you to send money for medical treatments in India, thus ensuring that your family receives the timely care they need in case of health emergencies.

Utility Bills

You can now pay your utility bills in India even while you're miles away from home. DeeMoney's updated service gives you options to choose from, when making various payments such as your electricity bills, water bills, or gas bills. So you can rest assured that your loved ones continue to enjoy uninterrupted services, while you make quick and easy payments from Thailand.

Payment of Property Rental

You can now manage your property rental payments at your fingertips! DeeMoney's updated service allows you to pay property rentals directly, ensuring a trouble-free experience for you and your tenants in India.

Insurance Premium

DeeMoney’s update helps you make hassle-free payments on your insurance premiums in India. So, you can now put your financial responsibilities at ease while ensuring timely premium payments on your medical insurance, health insurance, life insurance or property insurance.

Salary

Apart from the B2P salary payment service, you can also send salary remittance through P2B transfers. This particular benefit works great for freelancers or consultants working with Indian companies from Thailand.

DeeMoney has always focused on delivering services that are convenient, secure and time-saving. With the enhanced services options, DeeMoney’s financial commitments to India have now taken on a pragmatic transformation. Supporting your family and loved ones, managing your investments, paying your premiums and crediting salaries, without any trouble has now become a reality!

.jpg)

DeeMoney is a licenced entity under the “Authorized Money Transfer Agent License no. MT125590013”, “Money Changer License no. MC125600121”, “E-Transfer License no. Bor(4) 033/2561)” and “E-Money License no. Bor(2) 001/2565)” Issued by the Bank of Thailand and the Ministry of Finance.